Fiscal Innocence Law: Changes incorporated into the Tax Criminal Regime

Fiscal Innocence Law: Relevant Changes in the Application of the Tax Criminal Regime

I. Introduction

Last Friday, December 27, Congress passed Law No. 27,799, known as the “Fiscal Innocence Act”, which, among other amendments, introduces significant changes to the Tax Criminal Regime (Régimen Penal Tributario – RPT). The approved reform entails a substantial reconfiguration of tax criminal law, significantly increasing the thresholds for criminal liability and establishing an annual mechanism to update those thresholds. The reform also includes new procedural rules, statute-of-limitations provisions, and rules related to the extinction of criminal action.

The core of the reform is neither symbolic nor merely technical. It represents a reorientation of the system, seeking to reserve criminal prosecution for cases of real economic significance and legal reproach, while shifting to the administrative-sanctioning sphere those disputes arising from interpretative or technical differences or from matters with minor fiscal impact.

II. Update of Amounts for the Application of the RPT

One of the structural problems of the RPT is the rapid erosion caused by inflation of the objective conditions for criminal liability. Thresholds originally designed for serious misconduct end up encompassing situations commonly encountered in routine audits, resulting in an expansive use of criminal law.

The approved reform significantly raises the amounts and establishes an automatic annual update mechanism, aiming to reduce the recurrence of this problem in the future.

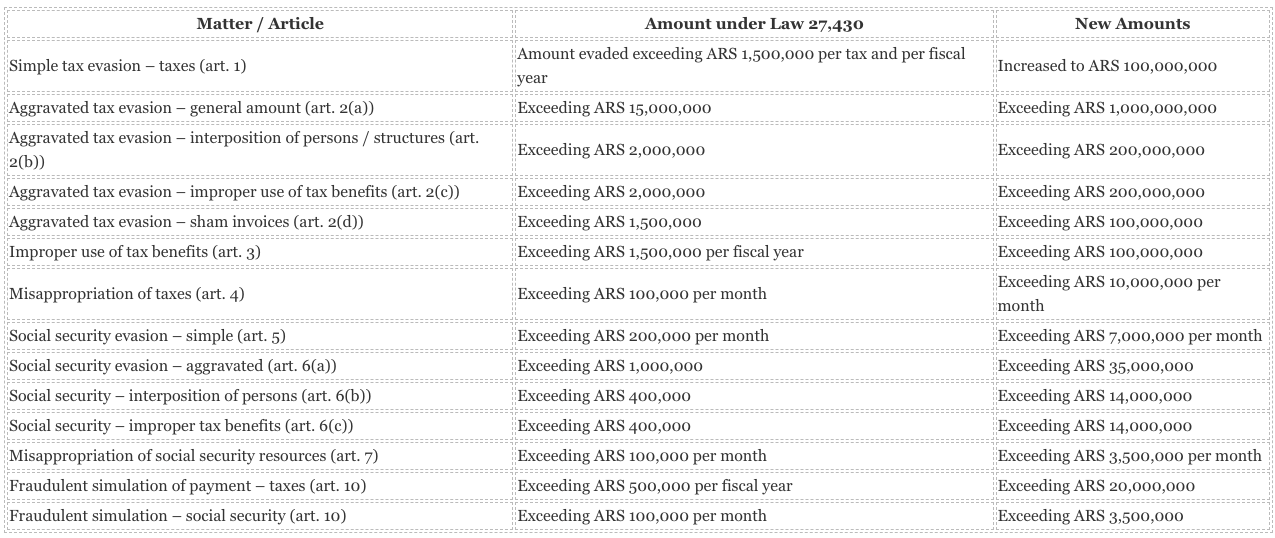

Below is a comparative table between the amounts established by Law 27,430 and those that will apply following the publication of Law 27,799:

The new amounts will be adjusted annually starting January 1, 2027, taking into account the annual variation of the Purchasing Power Value Unit (UVA) recorded between January and December of the calendar year immediately preceding the adjustment. The amounts determined under this mechanism will apply to the calendar year beginning after each update.

For purposes of assessing the configuration of offenses or other unlawful acts, the amount in force at the time of commission will be considered, understood as the due date for filing the relevant tax return or the date of the assessment or other instrument serving that purpose.

It is important to note that this express provision cannot exclude the application of the more lenient criminal law principle set forth in Article 2 of the Criminal Code, but it anticipates that the debate will shift to the judicial arena.

ARCA must publish annually the amounts that will take effect as of January 1 of each year.

III. Rules on Extinction of Criminal Action, Limitations on ” Exculpatory Payment”, and Exclusion of the Application of the ” Full Reparation of Damage ” Doctrine in Tax Matters

The reform maintains the mechanism for extinction of criminal action through payment of the debt (Article 16 of the RPT), but introduces significant changes by replacing the previous article.

The new Article 16 continues to apply exclusively to tax evasion offenses (simple and aggravated), improper use of tax benefits, and evasion of social security resources (simple and aggravated). That is, its application remains excluded for the remaining offenses under the RPT (misappropriation of taxes and social security resources and other common tax offenses included in Title III).

The approved amendment is substantial, as it establishes a specific case in which the tax authority must refrain from filing a criminal complaint (although limited to a single occurrence): if the amount corresponding to the evaded, improperly used, or unduly collected obligations, plus interest, has been unconditionally and fully paid prior to the filing of the complaint. In other words, if the taxpayer—before a criminal complaint has been filed—unconditionally and fully pays the evaded, improperly used, or unduly collected amounts together with interest, ARCA must not file a criminal complaint. This exemption applies only once per individual or legal entity.

If criminal action has already commenced, the reform introduces the possibility of extinguishing it if the evaded, improperly used, or unduly collected obligations and interest are unconditionally and fully accepted and paid, plus an additional amount equivalent to fifty percent (50%) of the total sum, within thirty (30) business days following the procedural act by which the criminal charge is duly notified. This possibility is not limited in its use and, in principle, may be used more than once. In this case, the legislature expressly determined the amount considered to repair the damage caused by the fraudulent conduct: not only must the evaded obligation and interest be paid, but also an additional sum equivalent to 50% of the total, all within the same time frame previously established by Article 16 of the RPT.

The reform adds to the RPT the first unnumbered article following Article 16, settling a long-standing judicial debate regarding the application to tax and social security offenses of the extinction of criminal action mechanism provided for in Article 59(6) of the Criminal Code (full reparation of damage).

The new provision expressly excludes its application to tax evasion offenses (simple and aggravated), improper use of tax benefits, and evasion of social security resources (simple and aggravated).

Additionally, a new article provides that tax and social security criminal action shall not proceed when the tax authority’s powers to assess the respective taxes and social security resources have become time-barred under applicable regulations. Thus, if the tax authority’s powers to assess the debt have expired, the criminal action cannot continue.

It should be recalled that the new law, in addition to amending the RPT, also modifies the limitation periods for the tax authority’s powers to assess taxes and collect social security debts, reducing them in certain cases. This could lead to some criminal actions currently underway being discontinued.

IV. Rules Governing the Non-Filing of Criminal Complaints

The final amendment to the RPT concerns the cases in which ARCA is exempt from filing a criminal complaint, as provided in Article 19 of the regime.

The new rule maintains the two cases established in the previous article (where the tax loss can be inferred to stem from differences in interpretation of the law or technical-accounting aspects of assessment, and/or where the adjusted obligations result exclusively from the application of presumptions), and adds two more:

-

Where taxpayers and/or responsible parties have expressly, duly, and reasonably disclosed the interpretative and/or technical-accounting criterion used to determine the tax obligation through a formal submission to the tax authority prior to or simultaneously with the filing of the relevant tax return, provided that the criterion invoked is not a means intended to distort the taxable base.

-

Where taxpayers and/or responsible parties file original and/or amended tax returns before any notification of the commencement of an audit in relation to the tax and fiscal period to which those returns refer.

Although for these two new cases the issuance of a reasoned opinion by the tax authority justifying the decision not to file a criminal complaint is not required, this requirement remains in place for the other two cases.

V. Conclusions and Entry into Force

The amendments to the RPT are part of a broader effort to rationalize tax criminal law. The increase in thresholds (which, although substantial, may still prove insufficient), automatic updates, the inclusion of additional cases exempting the Treasury from filing criminal complaints, and special rules on the extinction of criminal action through payment suggest a paradigm shift: less criminal law for ordinary tax disputes and greater focus on cases of serious fraud.

The real challenge will be practical implementation: how courts interpret the new rules and whether the tax administration effectively adjusts its complaint-filing criteria to this new standard.

Article 45 of Law 27,799 provides that it will enter into force as of the date of its publication in the Official Gazette.